As the dust settles on another holiday season, the Brain & Poulter team begins the year, as usual, with a comprehensive review of the last 12 month’s consulting work and analysis of the latest industry research. Our aim: to predict the hottest trends in food that will drive lease deals and retail planning in 2017.

Part of this process involves an honest assessment of some of our previous trend forecasts. We can say, with confidence, 80% of our previous predictions have come true within the year. The balance being a little slower to get to market but eventually taking hold.

Predictions for a rise in fresh food meal solutions, the home delivery boom, more chef driven quick serve restaurants (QSR) and the addition of food catering to other retail experiences have been game changers in the past year.

So what does the future hold? The answer to that question lies not only in understanding what we eat but how we eat.

The shift toward casual dining and explosion of QSR brands is undeniable. Combine this with fast food majors moving from food courts to pad sites and there exists an imperative to design centres that trade to the external surrounds and a rethink of how to keep our 2,000m2 food courts relevant.

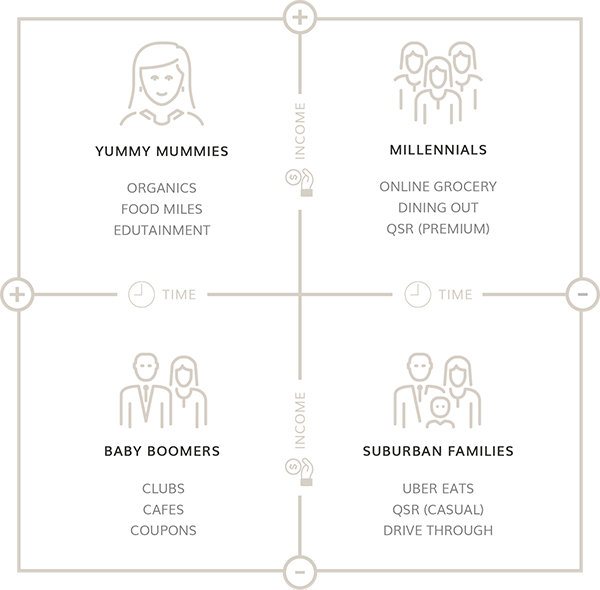

Generational and societal dining preferences also add to the challenge. More than ever we see the disparity of young vs old, Boomers vs Millennials. Groups with opposing incomes, tech savviness, time and values. Our infographic below outlines some of the wide variations in F&B needs dependent on a consumers income and time. The food experience within shopping centres is going to need to innovate like never before to cater to these diverse proclivities.

Infographic: How generations eat

Despite these challenges, shopping centre owners who develop in sync with macro food trends and pay close attention to the nuances of their trade area stand to ride the food boom.

McKinsey & Company recently estimated that food catering could move to 20% of centre GLA globally by 2020. Additionally, the table below indicates we have plenty of room to grow the category in Australia.

Source: Urbis Averages 2013-2015

Source: Urbis Averages 2013-2015

With this in mind, here’s what we envisage seeing in the coming year or two:

1. The Fresh & Dine Revolution

Fresh food precincts will continue their metamorphosis to seamlessly combine food catering, edutainment and curated culinary experiences. The average consumer, raised on cooking shows and an increasing awareness of health and wellbeing, will be searching for the latest meal innovations.

More curated fresh food precincts, supermarkets and unique fresh operators will incorporate a food catering element with brand ambassadors, cooking classes, sustainability & food ethics completing their offer.

Run the analytics first as this does not apply to all demographics. For example, Millennials are 40% more likely to shop online than average Generation X’ers. Nielsen Homescan also reveals that the average basket size of an online shopper is more than double that of the physical store average, which says something about how we shop when someone else is carrying the grocery bags.

Examples:

The Kitchens Robina Town Centre, Tramsheds Harold Park, Pacific Fair Fresh Food, About Life, Standard Food Market at Gasworks Brisbane, Harris Farm, Collins Butchery Sydney, Veganz Berlin, Herbivorous Butcher in Minneapolis, Suzy Spoons Sydney.

Tramsheds Harold Park, Sydney: A curated fresh food experience with a perfect blend of food catering.

Tramsheds Harold Park, Sydney: A curated fresh food experience with a perfect blend of food catering.

The Opportunity:

Re-mixing of fresh food precincts to include demonstration kitchens, ‘mezzanined’ cooking schools, extended CML offerings for local/seasonal/ethnically relevant produce.

The Threats:

- Declining in-store fresh food shopping causing the demise of traditional specialty food retailers

- Growing retirees on limited incomes outside CBD metro areas

- Growth in urban activity centres encouraging Millennials to live life online rather than in store

2. The Riches Are In The Niches

We’ve always loved our work in Asia where we can create tenancy mixes of 30 x 15m2 food court outlets with a laser focus on executing a single dish to perfection. However, creating a deep and specialised menu requires high population density and demand. That’s why the likes of cupcakes and pretzels have struggled in Australia where we don’t have bustling city streets a la New York. But as our population grows, immigration increases and we continue to pool around major transport and commercial hubs, the opportunity for niche food presents itself.

Also of note is that we still have many chefs trading down from the cost and intensity of fitting out and running formal dining venues to the more appealing business model of QSR’s. Many of these ‘niche’ operations are being swallowed up by super groups like RFG and UPG allowing these brands to scale up radically.

Examples:

Hot Star chicken, Uncle Tetsu’s Cheesecake, KitKat Chocolatory Melbourne Central, Protein Express Stockland Shellharbour, Supercharger fast vegan food at Emporium, Kellogg’s Cereal Restaurant Times Square, Chobani Yoghurt café Soho, Vegie Pret London.

KITKAT Chocolatory Melbourne: Design your own KITKAT. Does it get any more niche than this? Image source: www.one68.com.au

KITKAT Chocolatory Melbourne: Design your own KITKAT. Does it get any more niche than this? Image source: www.one68.com.au

Opportunities:

- Refining permitted menus to become deeper in specialisation rather than broader

- Increased CML in food courts and fresh food precincts to offer niche cuisines appealing to the trade area demographics

- Smaller tenancy sizes but increased variety of offers in food courts

The Threat:

Ability to do deals with a larger range of chained operators can lead to the addition of too many choices outside of highest demand cuisines leading to unsustainable trading and over-fooding.

3.Technology

From drone delivery to virtual reality dining, integrating technology with F&B can border on the gimmicky or seen simply as an opportunity to save on labour costs. However, used effectively, technology provides the experiential key so sought after today.

While Australia is generally slow to embrace technology here are a few things in action around the world.

Examples:

Food Ink 3D Food: Food, utensils and furniture produced through 3D printing.

Eatsa automat takeaway: Quinoa superfood bowls ordered by app or touchpad dispensed via hatch in 4 minutes. Saving around 30% on labour in 50sqm or less. Caters to a fast-paced CBD worker market.

Eatsa, USA: Bringing technology and health to fast food. Image source: eatsa.com

Eatsa, USA: Bringing technology and health to fast food. Image source: eatsa.com

Barkers Burger bar in Dubai: Driven by social media with entrance to the restaurant reliant upon finding a key through a quiz posted on Instagram and snapchat.

Inamo, London: Interactive table tops allow diners to view and order the menu items on a touch pad style table top.

Amazon Go: Amazon will open a bricks and mortar grocery store in 2017 in which customers can use a smartphone app to automatically pay for goods – no lines, no checkout.

The Opportunity:

Centres to embrace a whole of precinct technology strategy such as BOGO offers or time limited meal deal marketing via centre social media.

The Threats:

Speed of uptake by centres and operators to include technology in the food experience. 40% of millennials don’t carry cash yet still up to 20% of food retailers only take cash, limiting their ability to service millennial customers.

4. It’s All About the ‘Experience’

In a market where consumers demand an ‘experience’, shopping centre food precincts are competing with hip high street clusters, laneways and waterfront locations surrounded by entertainment options and/or scenic bliss. With growing F&B ratios in shopping centres and varying foot traffic to support it, entertainment and other experiential options are the key to driving visitation. This may require looking beyond the traditional cinema or bowling alley, but designing spaces that hold curated events, edutainment, pop ups, clubs, art and other social gatherings.

Examples:

Sublimotion Ibiza: A food experience enhanced through the ever-changing mood of the interior, which is achieved by dynamic lighting, sound, climate control and projection mapping. Popular despite the $1,000 per head price tag!

Sublimotion Ibiza: A fully immersive dining experience. Image source: www.sublimotionibiza.com

Sublimotion Ibiza: A fully immersive dining experience. Image source: www.sublimotionibiza.com

Bagger’s: A German concept now in Abu Dhabi, includes iPad ordering and delivery via a roller coaster service to your table. Kitsch but appealing to some.

Muse Paint Bars, USA: Drink wine, snack and socialise while learning to paint your own piece of take-home artwork.

The Opportunities:

- Whole of precinct festivals relevant to demographics e.g. Chinese NY

- Community partnerships for charitable collections

- Concerts

- Cooking demonstrations and other edutainment

- Food related ‘clubs’ eg. Chef’s Club NY

The Threat:

High Street precincts well supported by Council funding increasingly establishing market share such as Crown St Mall Eat Street in Wollongong, Cabramatta Moon Festival, Brisbane Food Truck & Entertainment Strategy at Southbank.

5.Food Anywhere Anytime

Consumers can now engage in food at home, in a stranger’s home, around the globe, on the beach or in the park. Delivery services, social networks and start-ups are all accelerating to the changing face of dining. Restaurants without seats which are taking off in high rent cities around the world, with trading hours extended and no longer based around the traditional time periods of lunch or dinner.

Examples:

Vizeat: A dining experience in a private home anywhere in the world. A great way to meet people while travelling and get an authentic experience. Don’t forget to Instagram it!

VizEat: “Meet People, Eat Locally” this app connects those who want to share an in-home dining experience around the world. Image source: vizeat.com

VizEat: “Meet People, Eat Locally” this app connects those who want to share an in-home dining experience around the world. Image source: vizeat.com

Chef Kiss: Order ‘home cooked’ food from individual foodies – Australia’s food safety laws may not enable this.

Pasta on Demand: Chef Michael White project, Pasta on Demand churns out dishes from a purpose built economical commercial kitchen, collaborating with Uber eats to deliver.

Chin Chin: With constant queues, this restaurant produces the time consuming cooking elements in an off-site kitchen and then finish meals in their compact restaurant kitchen. The result: less rent, optimised production and high table turnover.

Opportunities:

- Working with retailers to reduce their footprint by using off site commissary kitchens

- Creating dedicated parking spaces for food couriers near to centre restaurant precincts

- Adding casual kitchens for hire to restaurant mix for “in residence” chefs

Threats

- Technology and the micro economy being created by alternate meal providers such as home cooks

- Home delivery

So there you have it. If Brain & Poulter stays true to form, 4 out of 5 of these predictions will form a major part of any sound F&B strategy in 2017. It’s going to be another exciting year.

FREE 45 minute Keynote Presentation Available

B&P has a special 45 minute trends package ready to present free of charge to our clients across the first quarter of 2017 expanding on the above mentioned F&B trends. For an innovative, refreshing addition to your upcoming company conference, why not book B&P as your guest speaker?

Book us in NOW or call (02)8231 5799 before we get booked out.